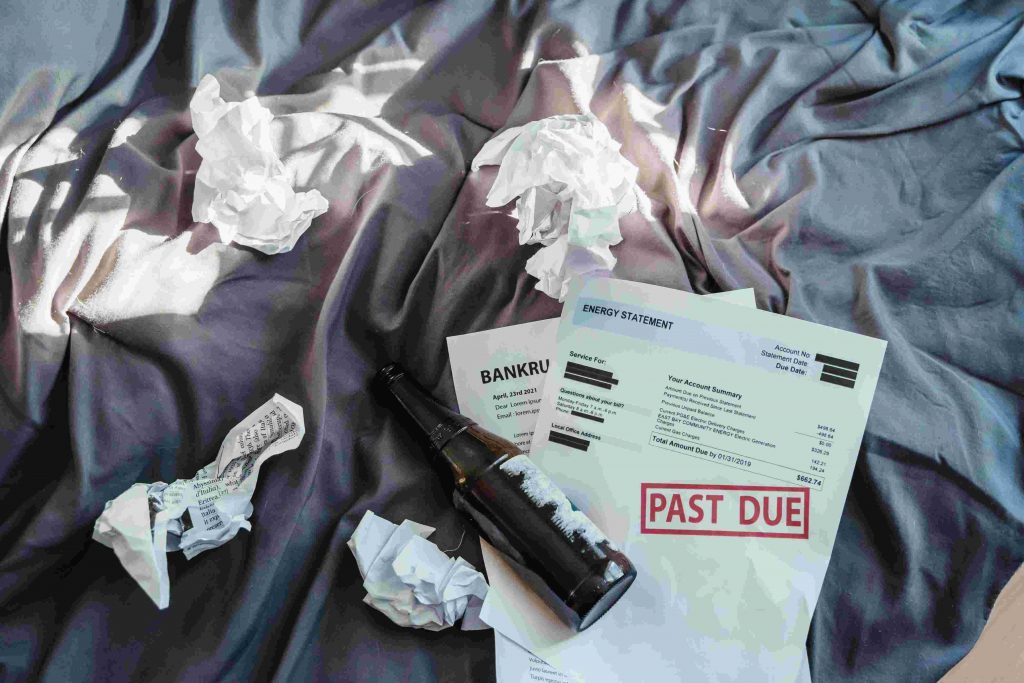

Filing for bankruptcy can be emotionally and physically draining, and sometimes it feels almost impossible to get out of debt. Filing for bankruptcy may seem like the best option at that moment, but it has its heavy consequences. Especially on your credit rating, bankruptcy might harm your credit score, and it might last for a period of up to 10 years. Therefore, filing for bankruptcy should be considered the last option, and it should also be a well-informed decision.

1. Know if You Qualify to File

The first step before filing for bankruptcy is taking a means test. It is an analysis that an independent trustee of your finances conducts to determine if you are qualified to file for bankruptcy. For chapter 7, your disposable income should be below the average income in your area, and for chapter 13 bankruptcy, you are required to have enough disposable income to settle your debts through a payment plan for the next three to five years.

Also included in the means test is an analysis of the last six months of your income, financial history to look for signs of bankruptcy abuse like cash advances within 90 days before filing, taking out a hefty amount in payday loans, and maxing out all your credit cards a week before filing.

2. Determine the Type of Bankruptcy

Before filing for bankruptcy, you need to decide which bankruptcy favors your interests. People file either chapter 7 or chapter 13, which are two different types of bankruptcies. Considering all of the filing bankruptcy in Canada pros and cons is important when determining the type of bankruptcy you are going to file for.

For example; chapter 13 bankruptcy ensures that your secured assets are protected, like stopping your house from being sold when you file; it also permits you to reorganize your debts and repay them for three to five years. However, in chapter 7, bankruptcy, some of your debts are discharged, meaning you don’t have to repay them, and a significant number of your properties are sold to settle your debts.

3. Seek Credit Counseling and Hire a Lawyer

You cannot file for bankruptcy before receiving credit counseling 180 days before filing. In addition, it is expected that you complete a debtor education course before your debts are discharged. You can only obtain counseling and debt education from education providers and counseling agencies authorized by the US trustee program.

Also, it is in your best interest to hire a bankruptcy lawyer to file on your behalf. A lawyer advises on which option is best and helps you comprehend the difference between chapter 13 and chapter 7 bankruptcy filing. But if you decide to file in Canada, there are a few pros and cons, like when your bankruptcy is discharged, you are debt-free.

4. Know the Effect on Your Credit Score and Filing Fee

The information about your bankruptcy stays on your credit report for ten years if you file for chapter 7 and seven years for chapter 13. It can also cause a decrease in your credit score, but after seven or ten years, the bankruptcy charge will be scraped off your record, and you can have a fresh start.

Additionally, you must pay a filing fee of 350 dollars which is mandatory no matter how bad your situation is. Other fees include administrative fees, lawyer fees, federal miscellaneous and credit counseling, and debt course fees.

5. Your Bankruptcy and Confidential Financial Information Become Public

Your case becomes a public record once you file for bankruptcy. The case will be in your credit report and bankruptcy court database, which the public can access. If you apply for a job, the employers will see this information if they conduct a background check.

You are also required to file a schedule of assets and liabilities, a statement of your financial affairs, a schedule of income and expenses, unexpired leases, and a schedule of executory contracts in addition to the bankruptcy filing. Therefore, anyone can access this information for free at the federal courthouse.

Before filing for bankruptcy, you should exhaust all your other available options as this might save you money and time.

Pingback: 5 Ways Fintech Software Development Is Helping Small Businesses - Blogger's Paradise

Pingback: How To Earn Credit Points With No Credit History

Pingback: How To Access The Hidden Job Market In Canada: Tips And Tricks